Shannon's Demon: how to profit from volatility in investing

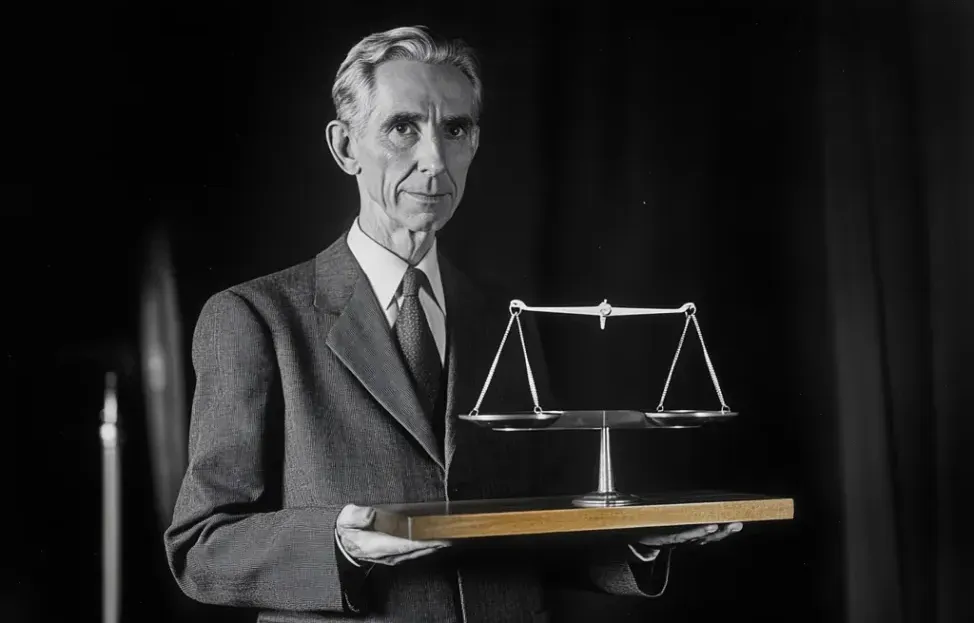

When you hear the word demon, you probably picture a mischievous creature stirring up chaos. But what if I told you there’s a financial “demon” that thrives on market volatility and can help you grow wealth without needing markets to soar? Enter Shannon's Demon, an investment strategy inspired by the genius of Claude Shannon, the father of information theory.

If you're not already intrigued, hold tight. We’re about to unpack a concept that makes volatility your ally and shows how smart rebalancing can create profits even in a flat market.

What Is Shannon's Demon?

Claude Shannon - the same visionary who decoded the fundamentals of information theory - applied his intellect to investing and developed a rebalancing strategy that thrives on fluctuations in asset prices. Unlike the standard approach of buying and holding, Shannon’s Demon profits from market swings by systematically buying low and selling high - In scientific papers this is also known as volatility harvesting or extra growth generated from a continuous rebalance of a portfolio.

First, you start with two types of assets. One should be volatile, such as stocks or cryptocurrencies, while the other should be more stable, like bonds, cash, or gold. These contrasting assets create the foundation for the strategy. The key is to allocate your portfolio between these two assets in fixed proportions - say, 50% each.

As the prices of these assets fluctuate, the balance in your portfolio shifts. For example, if the value of the volatile asset rises, it will take up a larger proportion of your portfolio. To restore the original balance, you sell some of the volatile asset and reinvest the proceeds into the stable one. Conversely, if the volatile asset loses value, you buy more of it using funds from the stable asset. This systematic rebalancing allows you to capture returns from price fluctuations, even when the overall trend is flat.

Fun fact: Claude Shannon didn't call it a "demon" himself - the term emerged later, drawing parallels to Maxwell's demon in physics since both concepts appear to create order from randomness.

A simple example: Shannon’s Demon in action

Imagine you invest $100, splitting it evenly:

- $50 in a volatile stock.

- $50 in a stable bond.

After a month, the stock’s value increases to $60, while the bond’s value decreases to $40. At this point, your portfolio is no longer balanced; the stock now accounts for 60% of your total, and the bond only 40%. Following Shannon’s strategy, you rebalance by selling $10 worth of stock and investing it back into the bond, restoring the 50/50 allocation.

Now imagine repeating this process over several months. Each time prices swing, you’re locking in gains by selling high and buying low. Over time, these small adjustments compound, allowing your portfolio to grow steadily, even if the stock and bond don’t exhibit a long-term upward trend.

Why Shannon’s Demon works

The effectiveness of Shannon’s Demon lies in its ability to exploit volatility and uncorrelated assets. Let’s break this down:

- Volatility becomes your ally: while most investors view market swings with anxiety, Shannon’s Demon uses them as opportunities. Price fluctuations are the fuel that powers this strategy. The more regular fluctuations, the better.

- The rebalancing bonus: this approach is similar to the myth of consistently buying low and selling high, generating returns - or better said non losses - from the natural ebb and flow of prices.

- Diversification magic: the strategy is most effective when the two assets are uncorrelated or negatively correlated. This minimizes overall risk and ensures that when one asset zigs, the other zags, creating profitable rebalancing opportunities.

Fun fact: Shannon originally demonstrated this concept using a mechanical coin-flipping machine he built, showing how regular rebalancing could produce gains even with perfectly random outcomes. The machine still exists and is housed at MIT.

The benefits of Shannon’s Demon

This strategy offers several advantages for investors:

- Risk reduction: by maintaining a balanced portfolio, you avoid overexposure to any single asset class, reducing overall risk.

- Steady gains: the approach generates consistent returns, even in markets that are otherwise stagnant.

- Simplicity: unlike complex trading systems, Shannon’s Demon is straightforward and requires minimal active management.

Fun fact: the concept has found applications beyond finance - in computer network load balancing, energy grid management, and even data center resource allocation, where regular rebalancing of resources can improve overall system efficiency

Potential pitfalls and limitations

While Shannon’s Demon is powerful, it has significant limitations that investors should consider:

- Market oscillation requirements: the approach works well when the market oscillates consistently, like a coin flip with regular ups and downs. This allows the rebalancing to capitalize on the fluctuations and generate returns. However, no stock is anywhere near that volatile.

- Non-losses vs. true profits: the gains from this approach are not true profits but rather "non-losses," as it mitigates the negative impact of losses due to market fluctuations. When a portfolio experiences both gains and losses, the net effect is slightly negative due to the compounding effect of percentage changes. Rebalancing helps reduce this negative impact but doesn’t entirely eliminate it.

- Synchronization challenges: rebalancing is beneficial when the frequency of rebalancing is synchronized with the frequency of market fluctuations. This is difficult to achieve because market frequencies are constantly changing and unpredictable.

- Impact of market drift: the effectiveness of rebalancing diminishes in the presence of market drift, which refers to the overall upward or downward trend of the market. In a consistent upward drift, the benefits of rebalancing are often outweighed by the growth of the market. Also, you will erode some of the compounding effect on the asset that is growing.

- Transaction costs and taxes: commissions and taxes can erode the gains from rebalancing. Frequent rebalancing leads to more transactions, resulting in higher commission costs and potential tax liabilities, which can offset the benefits of rebalancing.

Several researchers and analysts have explored the principles behind Shannon’s Demon. Back testing studies have generally validated its efficacy under certain conditions, particularly when the assets are sufficiently volatile and uncorrelated. However, results also show that the strategy’s performance is highly sensitive to these factors. For instance:

Funds and ETFs inspired by Shannon’s Demon

While no major ETF or mutual fund explicitly brands itself as a "Shannon’s Demon" fund, several products and approaches follow similar principles. These include:

- Risk parity funds: Funds like AQR Risk Parity Fund (AQRIX) aim to balance risk across asset classes, similar to the rebalancing principle of Shannon’s Demon.

- All-Weather portfolios: Inspired by Ray Dalio’s principles, these portfolios maintain diversified allocations across asset classes and rebalance periodically.

- Volatility harvesting ETFs: Some ETFs, like Invesco S&P 500 Low Volatility ETF (SPLV), capitalize on volatility dynamics, though not identical to Shannon’s approach.

Is Shannon’s Demon right for you?

Shannon’s system is an example of what is now known as a constant proportion rebalanced portfolio. Given certain assumptions, the optimal portfolio is always a constant-proportion rebalanced portfolio. Commissions and capital gains taxes cut into this benefit, though. This might impact some investors less than others, based on their broker and tax fee though.

Fun fact: Shannon himself never traded using this strategy in any significant way. When asked why, he reportedly said something along the lines of "The market is much more complicated than a coin flip" - showing his understanding of real-world limitations.

So, the next time the markets swing wildly, don’t panic. Channel your inner Shannon and let the Demon do its work. You might just find that chaos is the key to unlocking wealth.