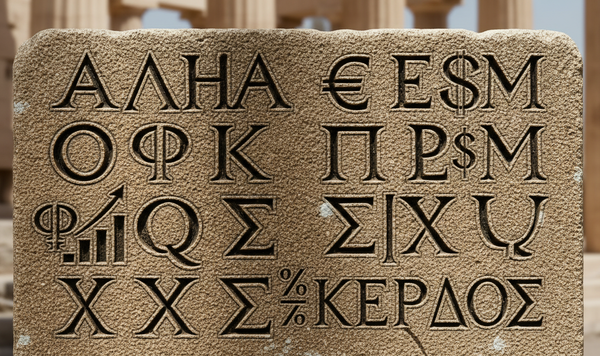

Getting started in stocks: the basics for beginners

Are you interested in investing in stocks but don't know where to start? If so, you’re not alone. Investing in the stock market can be a great way to create passive income and build wealth for your future, but it can also be intimidating if you are just getting started. Good news is that with the right knowledge, anyone can begin investing confidently and successfully. To help get you on the right track, here's an overview of some of the basics for beginners when it comes to stocks.

What stocks are and how they work

Stocks are probably the most exciting among asset classes, many people have got wealthy (or rich!) through them, while others have lost a lot money by making the wrong decisions.

Stocks (also known as equity or shares) represent a part in ownership of a company and are generally a way for companies to raise money in order to expand or improve their operations. When a company issues stocks, it is essentially selling little pieces of itself, known as shares. As an investor, you’re purchasing one of these shares and become part-owner of the company (small or large).

The value of the company is determined by how much money it generates and its profits. However the share price follows the law of supply and demand: when a company does well, typically people want to buy more shares (and offering more money) making the stock price rise, allowing you to make money if you decide to sell your shares at a higher price than when you bought them. On the other hand, when a company isn’t doing so well, the stock price is likely to drop so you could lose money if you decide to sell your shares at a lower price than when you bought them.

The different types of stock investments

When investing in stocks, if we simplify a bit, there are at least three main aspects you have to pick from:

-

Stock type:

- Size: you can purchase stocks of small, medium or large companies.

- Style: growth or value. Growth stocks are those companies that are considered to have the potential to outperform the overall market over time. Value stocks are classified as companies that are currently trading below what they are really worth and will thus provide a superior return.

- Geography: You have the option to invest in either a domestic (US) or international stock exchanges.

- Sector: you can decide which industry sector you want to invest and buy stocks from that sector. For example, you can buy stocks from the technology, retail or energy sector.

-

Vehicle:

- Standalone: it's the simplest form, and you buy directly stocks of a given company.

- Fund: it provides individual investors with access to diversified, professionally managed portfolios, according to the kinds of securities they invest in, their investment objectives, and the type of returns they seek e.g mutual funds, exchanged traded funds (ETF).

- Derivatives: this vehicle is probably the most advanced. A derivative instrument is an asset whose performance is based on (derived from) the behaviour of the value of an underlying asset (usually referred to simply as the ‘underlying’). The most common underlyings are commodities (e.g. tea or pork bellies), shares, bonds, share indices, currencies and interest rates. Derivatives are contracts which give the right, and sometimes the obligation, to buy or sell a quantity of the underlying, or benefit in another way from a rise or fall in the value of the underlying. e.g. stock options, futures, warrants, etc. high return but high risk.

-

Strategy:

- Long-term investments: long-term investments involve buying stocks over a period of time with the goal of earning profits in the future as the value of the company increases.

- Short-term trades: short-term traders typically buy and sell stocks in hopes to make money quickly by trading them in a short amount of time, leveraging the price fluctuations of every day.

How to research which stocks to buy

The best way to do this is by thoroughly researching the company you’re interested in before investing, and gathering information from different sources. Reading news related to the company, reviewing its financial statements and SEC filings, reading analyst reports, and understanding how its industry works are all important components of researching stocks. Every brokerage platform also includes a set of filters you can use to screen for particular stocks.

Buying and selling stocks

Stocks are traded on stock exchanges, such as the New York Stock Exchange, Nasdaq and others. The only way to buy or sell shares is to use a stockbroker. There are two types of broker: retail (for private investors) and corporate (that act on behalf of companies).

The procedure is simple: you register with the broker of your choice (typically in a few minutes on their website), you submit some documents and deposit some money. Several countries do have accounts that offer tax benefits, therefore it’s important to read reviews from other investors and compare fees and services before selecting your broker.

Diversifying your stock portfolio

Diversifying means investing in different stocks from various industries, companies, and markets so that if one stock performs poorly, you’re not putting all of your eggs in one basket. Diversifying is a great way to reduce risk and maximize your chances of making profits. The benefits of diversification and risk reduction are minimal beyond the 20/25 stocks threshold. Owning hundreds of additional stocks takes away the potential of big gainers. You can also diversify by investing in different types of investments such as stocks, bonds, mutual funds, and ETFs.

It’s also important to keep track of your stocks by monitoring their performance. This will help you determine which stocks are performing well and which ones should be sold or replaced in order to increase the potential for higher profits. Finally, make sure to regularly review your portfolio and adjust it according to your financial goals and risk tolerance.

The risks and rewards of investing in stocks

Stocks can be very rewarding, with an average return of 7%-10% per year stocks are one of the best choice for generating wealth. At the same time it’s important to understand that investing in stocks is not a guaranteed way to make money.

Before investing, make sure you have a good understanding of the stock market and how different investments work. It’s also important to remember that the stock market can fluctuate rapidly, so even if you do your research, there’s always the chance that you could lose money. But if you invest wisely and diversify your portfolio, you can reap the rewards of investing in stocks for years to come.