Crash course on investing in diamonds: how to evaluate quality, maximize return, and minimize risk

Diamonds are a girl's best friend, or so says a famous jazz song by Carol Channing. Diamonds, the gems that have symbolized love and marriage for decades, are beginning to attract wealthy investors as a commodity investment with potentially high returns and have, even more than gold, always evoked a strong charm towards men. Like for gold, diamonds get their value thanks to their difficulty of extraction and they maintain a high and stable price because not many are extracted each year. The question is, how do you start investing in diamonds?

What are diamonds and why invest in them

Diamonds are the most precious gems on earth, formed deep within the Earth’s mantle over 3.3 billion years ago due to extreme heat and pressure. In this environment, the carbon atoms in a diamond uniquely bond in pyramid structures.

Diamonds are a rare and beautiful gem, perfect for creating stunning jewelry. But that's not all these rocks can do - they also have unique molecular properties making them ideal tools in industrial applications like cutting or drilling into hard materials. While 30% of diamonds head to experts who turn them into sparkling pieces of jewelry, the remaining 70% go on to become part of powerful machines transforming everything from woodwork to metal.

Diamonds are:

- The hardest natural material known to man

- The most effective heat conducting material, which also expands very little when subjected to high temperatures, unlike most other conducting materials

- Resistant to most acids and alkalis

As an investment, diamonds offer a number of benefits: they are durable, portable, less prone to market fluctuations than other investments, and can even appreciate in value over time.

The diamonds value chain

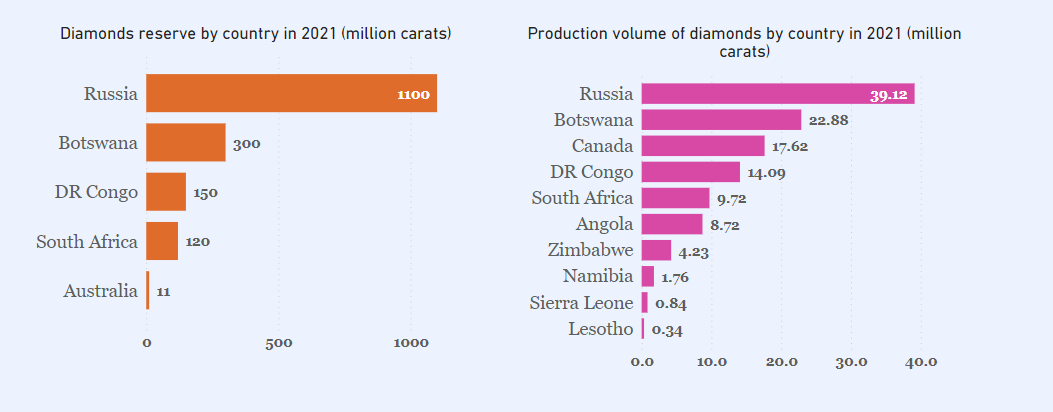

- Exporation: the majority of diamonds are concentrated in a handful of countries (see chart below) and often exist within kimberlite rock. Diamond prospectors search for such mineral to find deposits.

- Mining: once diamonds are detected, they are extracted with different procedures, depending on where they are found:

- Open pit mining: if diamons are on the surface of the ground

- Underground mining: if excavation (over 1 km below ground) is needed.

- Alluvial extraction: when diamonds are found in sand, gravel and clay that has been naturally transported by water erosion and deposited along water streams or deposits.

- Sorting: depending on size, shape, quality and color diamonds are sorted and valued. The best quality diamonds are distributed to the gem market, while the rest are used for industrial purposes, sich as cutting and drilling.

- Cutting & Polishing: once they arrive at the diamond centres, experts (known as ‘diamantaires’) cut and polish the rough diamonds into shapes. A new classification is made by their "Four Cs" (read below) before they are sold to diamond wholesalers or diamond jewellery manufacturers.

- Jewelry manufacturing: wholesalers will now sell diamonds bought to jewellery designers, manufacturers or retailers.

- Retailing: diamond jewellery is sold by retailers to the consumer.

How to evaluate diamonds for quality

The very first step is to learn the diamond language, the 4 Cs:

- Color: diamonds are assessed on a scale ranging from D (colorless) to Z (light yellow). The color evaluation of most gem-quality diamonds is based on the absence of color. A chemically pure and structurally perfect diamond has no hue, like a drop of pure water.

- Clarity: natural diamonds are the result of carbon exposed to tremendous heat and pressure deep in the earth. This process can result in a variety of internal characteristics called ‘inclusions’ and external characteristics called ‘blemishes', which affect the clarity of diamonds. To assign a clarity rating, diamonds are examined under 10x magnification and graded from Flawless (FL) to Included (I).

- Cut: this refers to how well a diamond’s facets transmit light and sparkle. Diamonds have different cuts ranging from the traditional round brilliant cut to the more intricate princess cut. A diamond’s cut affects its fire, brilliance and scintillation making it an important factor in evaluating diamonds for quality.

- Carat weight: diamonds are measured in carats, with one carat equaling 0.2 grams. Each carat can be subdivided into 100 ‘points.’ This allows very precise measurements to the hundredth decimal place. Larger diamonds tend to cost more per carat because they are rarer and more valuable than smaller diamonds.

Different types of diamonds and their value

In addition to the 4Cs just explained, there is distinction between natural diamonds, which are mined from the earth, and lab-created diamonds, which are created in a laboratory setting. Both have the same chemical properties and offer similar beauty but vary in cost. As you can imagine, natural diamonds tend to be more expensive due to their scarcity and rarity; lab-created diamonds on the other hand, can be manufactured to order and tend to be cheaper.

More shoppers are saying "I do" to a lab-grown diamond engagement ring. In 2022, lab-created diamonds accounted for nearly 10% of diamond sales, and their popularity is growing exponentially. "A lab-grown diamond is not a diamond simulant like cubic zirconia or moissanite," explains Dr. Sally Magaña, a Gemological Institute of America (GIA) research scientist. "Laboratory-grown and natural diamonds have essentially the same physical and chemical properties. Plus, a lab-grown diamond has the same sparkle and fire [as a natural diamond]." "Laboratory-grown and natural diamonds have identical physical traits," says Dr. Magaña. "Therefore, whether a diamond is natural or laboratory-grown, there are not many differences regarding what you will see." She explains that the major differences are more intangible.

Another distinction is color. Only about 1 in every 10,000 diamonds are colored, and the coloration is caused by trace amounts of certain elements within the stone. The exception are red and pink diamonds that are created as a result of extreme heat and pressure during their formation. Colored diamonds represent a very good form of investment because the supply is limited and the demand is constantly rising.

Where to buy diamonds at the best price

The diamonds market is huge and complex, so it’s important to do your research before investing. It is always better to buy diamonds from alternative vendors such as online or wholesale retailers, where prices are often lower than traditional banks. By doing a little bit of digging you can find diamonds at discounted prices below the market value, giving you the best return on your investment. A couple of popular stores are Clean Origin, Blue Nile, James Allen.

When buying diamonds, it is also important to make sure that they are ethically sourced and conflict-free. This will ensure that your diamonds were mined with respect for human rights and in compliance with international laws.

Tips on how to maximize return on your investment

Experts suggest to limit your choice on diamonds between 0,5 and 2 carat. Diamonds under 0,5 carat don’t require a grading report while above 2 carat stones are more rare thus it is harder to find a buyer. Make sure to get a certificate from a gemological institute that testifies the quality and characteristics (the 4 Cs discussed above).

Once you have purchased diamonds, there are a few tips that can help you maximize your return on investment. First, store them in a secure and insured location to protect against theft or damage. Second, keep up with the diamond market to track the diamonds’ value over time and take advantage of rising prices when it is feasible. Third, diamonds can be passed down as a family heirloom and may appreciate in value with each generation.

Finally, consider diversifying your diamond portfolio by buying diamonds of different shapes, sizes, colors, and qualities so that you have a mix of diamonds that could provide better returns in the future. As example if you had set your diamond investment budget on $20,000 then you should consider buying 2 x $10,000 diamonds or even split it into three. On top of that, don't buy two / three diamonds of the same type.

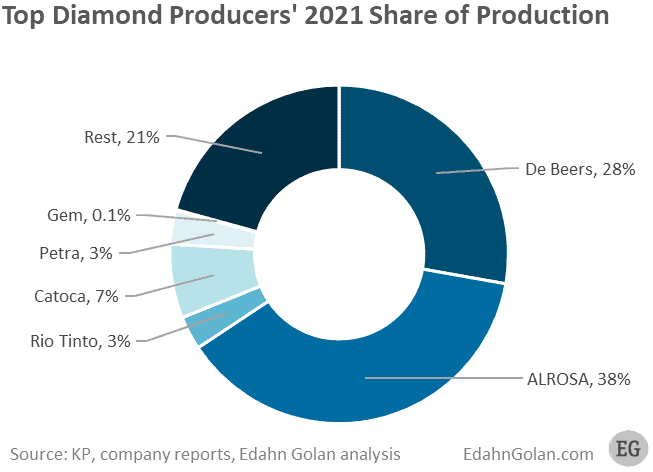

Although at the time of writing there is no alternative ETF that specializes in diamonds, you can still invest in companies related to them. For example, more than 60% of the diamond mining industry is held by four major companies:

- ALROSA: held mainly by the Russian government is the world's largest producer of mined diamonds.

- De Beers: diamonds became a symbol of love thanks to De Beers, thanks also to their famous commercial "A diamond is forever".

- Rio Tinto: anglo-Australian multinational company that is the world's second-largest metals and mining corporation.

- Petra Diamonds: with operations focused in Africa, they are known for mining large diamonds.

You can also invest in the diamond jewelry companies such as Tiffany and Harry Winston which is a combination of a mining company and a retailer.

Risks associated with investing in diamonds and how to minimize them

Like any investment, diamonds come with risks that need to be taken into consideration. These include diamonds being lost or stolen, having a lower value than expected, and diamonds not appreciating at the rate you were hoping for. To minimize these risks, it is important to do your research before investing in diamonds and purchase diamonds from reliable vendors that have good reputations.

By following these simple steps and investing wisely, diamonds can be an excellent choice for those looking to diversify their portfolio (don't hold more than 5% of your total portofolio value).