Central Banks: understanding monetary policy & investment impact

Welcome to your one-stop resource for understanding the complex world of central banking, where we'll be peeling back the layers to examine the roles and functions of these financial titans. We're diving deep into what a central bank is, what function it performs and use examples from some of most important central banks in the world. Buckle up!

And in case you missed my other article about the difference between monetary policy and fiscal policy, you can check it out here.

Where it all began

Central banks originated in the late 17th century as a response to the need for stable financial institutions that could regulate and manage the issuance of currency.

Fun fact: the first bank in history was Banca Monte dei Paschi di Siena, in Italy. It was founded in 1472 and still exists today, making it the oldest surviving bank in the world.

The Bank of Sweden, known as Sveriges Riksbank, is widely considered to be the first central bank established in 1668. Its primary purpose was to stabilize the Swedish economy by issuing banknotes and maintaining the value of the currency.

The Bank of Sweden served as a model for other countries, and soon after its establishment, central banks started to emerge in various parts of Europe. These early central banks laid the foundation for modern monetary systems and played a crucial role in fostering economic stability and development. Over the centuries, the functions and roles of central banks have evolved, and today, they are key institutions responsible for managing monetary policy, regulating financial systems, and promoting overall economic stability worldwide.

Central banks today

If Sweden started it all, today there are over 180 central banks in the world; the most important include:

- Federal Reserve (Fed) - USA

- European Central Bank (ECB)

- Bank of England (BoE)

- Bank of Japan (BoJ)

- The People's Bank of China (PBOC)

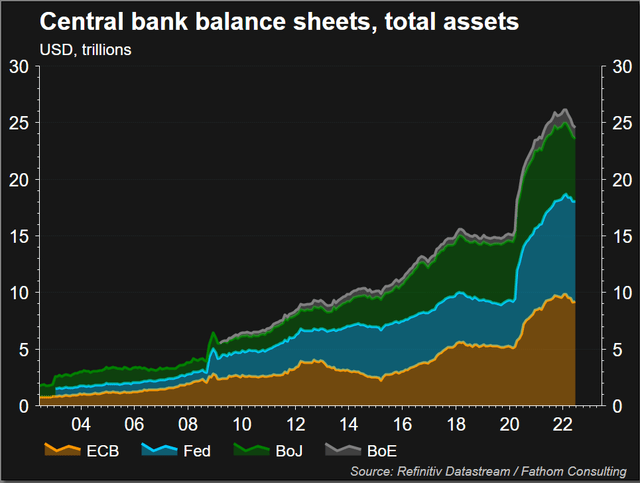

The number of banks is not the only thing that has grown in the past years. Given the multitude of significant financial events that we've been facing since the early 2000's, Central banks have increased the level of support provided to the countries, in many cases by buying massive amount of assets (mostly Government bonds):

But why are central banks buying so many bonds? And what are the responsibilities of a central bank? The foremost goal of a Central bank is maintain price stability. This is achieved by a mix of the following actions:

- Monetary policy: control the money supply and interest rates.

- Financial stability: this includes supervising banks and other financial institutions, and providing liquidity to the financial system during times of stress.

- Payments and settlement: this includes clearing checks and processing electronic payments.

- Economic research: this research includes collecting data, analyzing economic trends, and forecasting future economic conditions to make informed decisions about monetary policy and financial stability.

Let's have a deeper look at what they main ones mean.

Monetary policy: it's (often) a matter of inflation

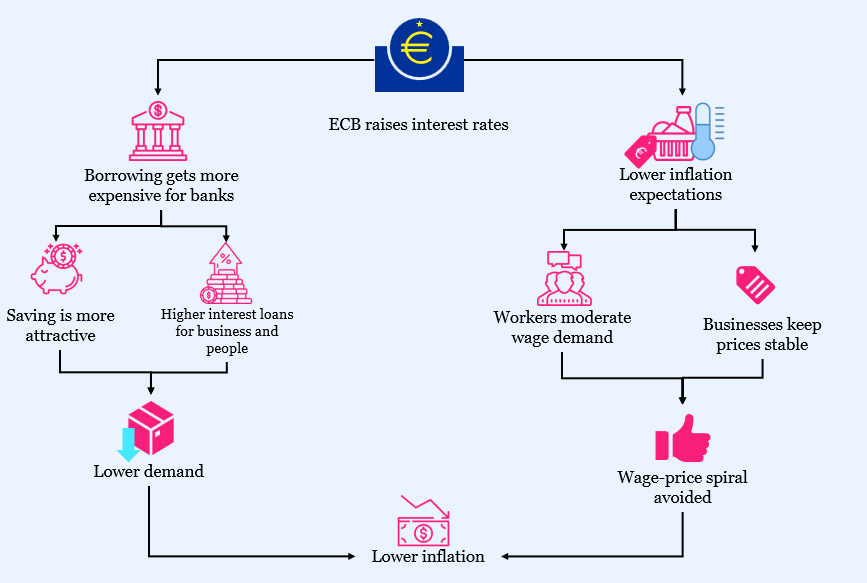

When it comes to monetary policy the big lift is done by keeping inflation at a healthy level, that is price stability. All the major Central banks are pretty much aligned on having an inflation target of 2%, which allows prices to increase gradually over time without causing too much disruption in the economy, while also providing incentive for businesses to invest in new technology and resources which can help stimulate growth.

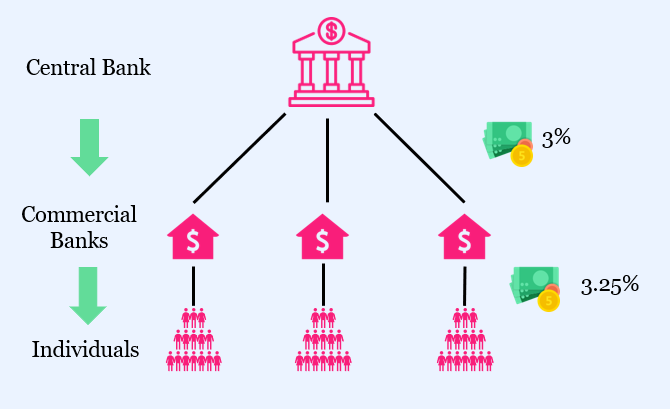

Central banks control inflation by manipulating interest rates. The interest rates that a Central bank can manipulate vary by country, but the main one is the policy rate that is the interest rate that the Central banks charges commercial banks for borrowing money from it.

Lowering rates can stimulate spending and investment, but at the risk of inflation; conversely, raising rates can curb inflation but may slow economic growth.

Historically, economists assume it takes about 18 months for monetary policy changes to fully materialize in the real economy, hence a change in interest rate today will take some time to really be visible at macro level. This is because first the "domino effect" takes time to propagate (through the different layers) and second people (and companies) might have savings or financial products with locked-in/inflation hedged interest rates.

Interest rates have been on a rollercoaster

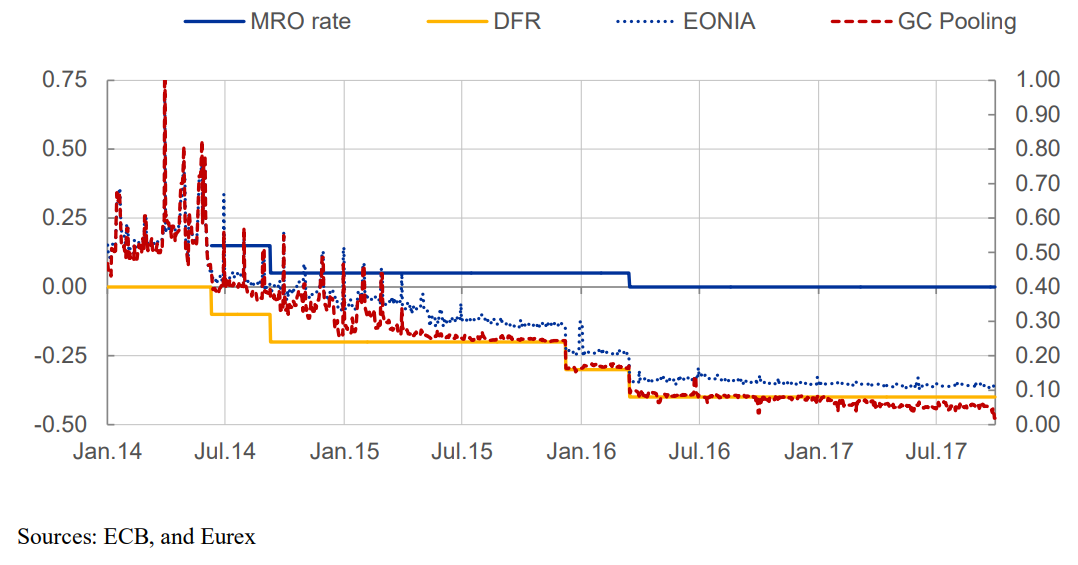

While the BoJ, Fed, and BoE have used a zero or close to zero interest rate policy at different points to stimulate growth (notably after the 2008 financial crisis), the ECB took it a step further by adopting negative interest rates in 2014. This bold move was an attempt to drive banks to lend more, thus boosting economic activity.

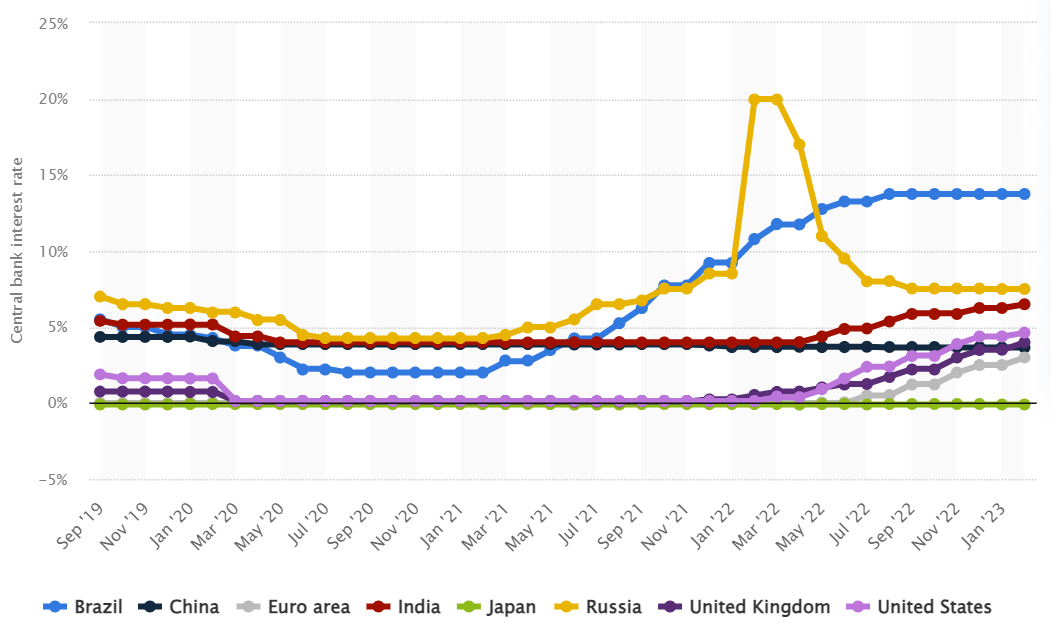

In the period of 2022-2023 inflation has been heating up like a sizzling barbecue, and central banks have been reaching for the proverbial fire extinguisher by raising interest rates.

Monetary policy: other aces up central banks' sleeve

If controlling interest rates is definitely the most used maneuver by central banks, there are other things that they can do to target price stability:

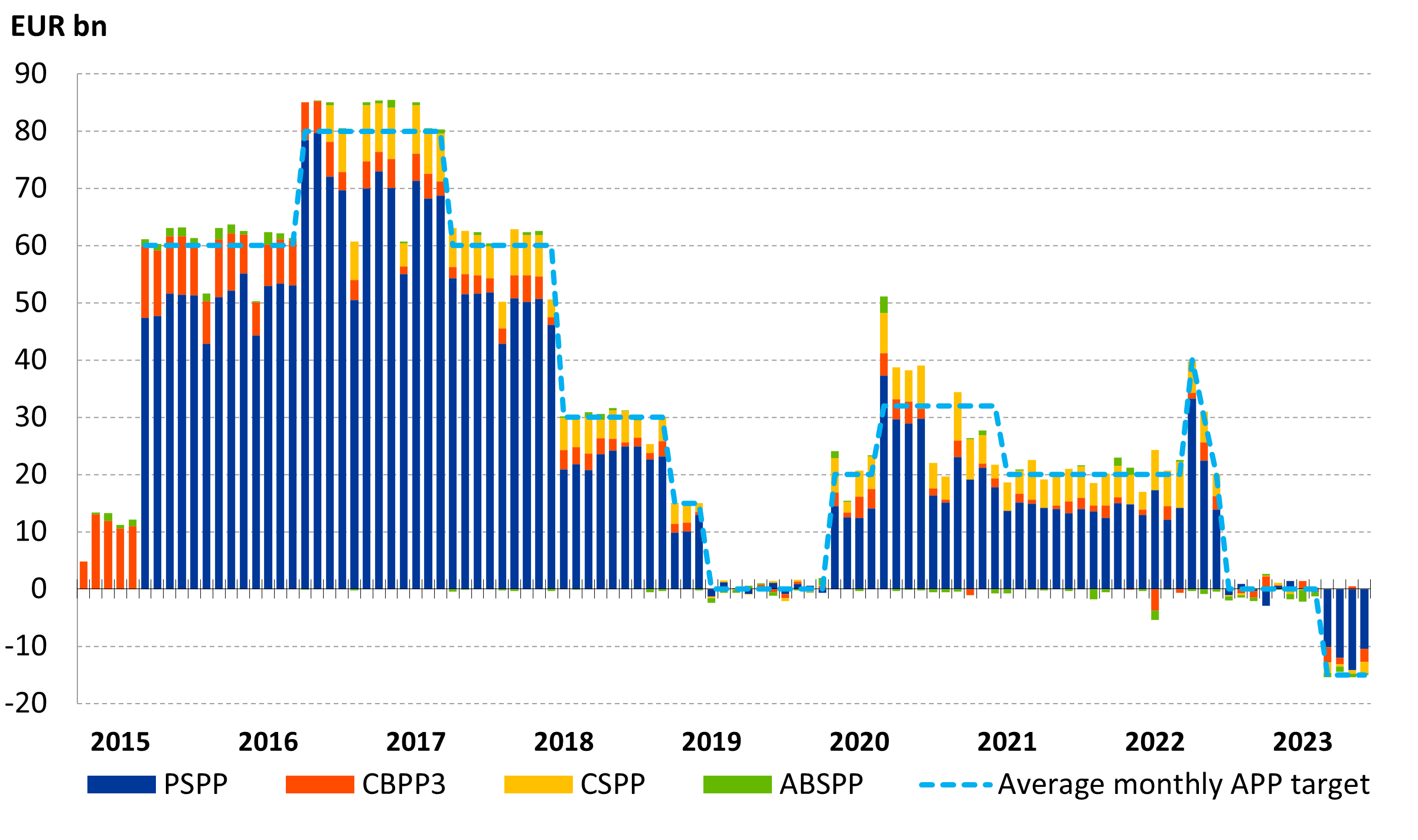

- Open market operations: as we briefly mentioned in the beginning, a common tool used by central banks involves buying or selling government bonds on the open market. For example, if the central bank wants to increase the money supply, it buys government bonds, thereby circulating more money in the economy. If it wants to decrease the money supply, it sells government bonds, effectively taking money out of circulation. The ECB for example has been providing a lot of support through different programs, especially since 2014, many of which are wrapped under the term APP (Asset purchase programs). Given the high level of inflation that started in 2022, the ECB decided to lighten up its balance sheet by starting selling government bonds bought in previous years.

- Changing the reserve requirement: Banks are required to hold a certain percentage of their deposits in reserve, i.e., they can't loan it out. By adjusting this percentage, the central bank can control how much money the banks are able to create through loans. Lowering the reserve requirement increases the money supply by allowing banks to make more loans, and raising it reduces the money supply.

- Interest on Excess Reserves (IOER): Central banks may choose to pay interest on the reserves held by banks in excess of the required reserve. When the central bank increases this rate, it incentivizes banks to hold more money in reserve instead of lending it out, thereby reducing the money supply.

- Quantitative Easing (QE): This is a more unconventional tool that has been used especially during periods of significant economic downturn, such as the financial crisis of 2007-2008. In QE, the central bank creates new money and uses it to buy securities (like government or corporate bonds) from financial institutions. The aim is to lower long-term interest rates, encourage lending, and stimulate economic growth.

Fun fact: During the financial crisis of 2008, the US Federal Reserve launched a whopping $4.5 trillion QE program to breathe life into the economy.

Financial stability: a delicate balancing act

A central bank’s role in ensuring financial stability can't be overstated. By supervising and regulating banks, central banks mitigate risks that could escalate into a financial crisis.

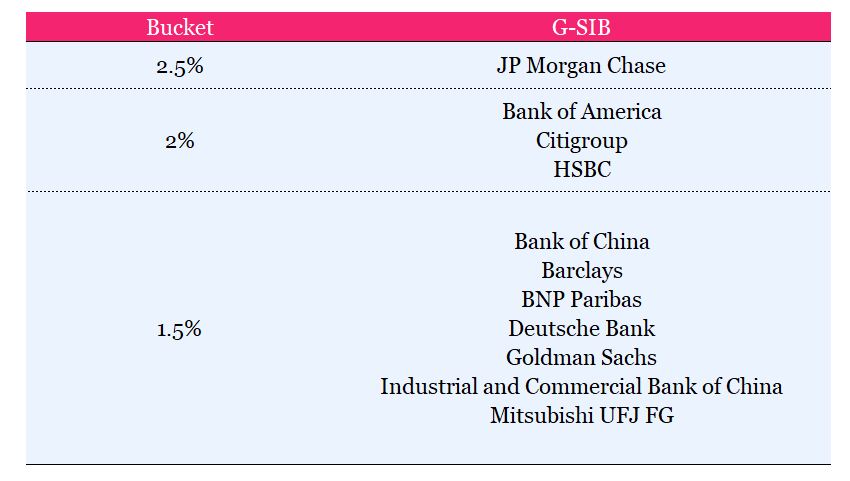

Remember the 2007-08 financial crisis? The Fed was criticized for not intervening earlier to prevent excessive risk-taking. Since then, regulatory measures, such as the Dodd-Frank Act in the US, have been adopted to bolster oversight and protect against future crises. The 2010 Dodd-Frank Act established the Financial Stability Oversight Council (FSOC), giving it the authority to label banks and other financial institutions as SIFI (Systemically Important Financial Institution), or often referred as "significant". The goal was to prevent a repeat of the 2008 financial crisis, which saw largely unregulated institutions such as American International Group Inc. require large taxpayer-funded bailouts. A bank can be deemed significant based on its size, its complexity, its interconnectedness, the lack of readily available substitutes for the financial infrastructure it provides, and its global (cross-jurisdictional) activity. Each central bank though adds specific requirements and thresholds.

Fun fact: while in Europe the minimum total value of assets is set at €30 billion, in US the threadsold is at a whopping $250 billion. This can allow banks to stay "under the radar" until too late.

The obligations of a significant bank vary depending on the country and regulatory regime. However, there are some general obligations that are common to most significant banks. These include:

- Higher capital requirements: Significant banks are often required to maintain higher levels of capital compared to smaller banks. Adequate capital serves as a buffer against unexpected losses and helps ensure the bank's ability to absorb shocks and continue its operations.

- Stricter risk management practices: Significant banks are expected to implement robust risk management practices to identify, measure, monitor, and control various types of risks, such as credit risk, market risk, liquidity risk, and operational risk.

- Enhanced supervision and reporting: Regulators subject significant banks to more intensive supervision, including regular examinations and stress tests. These banks may also need to provide more detailed and frequent reports on their financial condition and risk exposure.

- Public Disclosure and Transparency: Significant banks often have greater disclosure requirements to provide the public with information about their financial condition, risk exposure, and business practices.

- Restrictions on Activities: Depending on the jurisdiction and regulatory framework, significant banks may face restrictions on certain high-risk or speculative activities to safeguard against excessive risk-taking.

Central banks' take on cryptocurrencies

Central banks have been closely monitoring the crypto revolution, and they have mixed feelings about it. While they acknowledge the potential of blockchain technology and digital currencies to transform the financial landscape, they also have concerns about the risks and volatility associated with cryptocurrencies. In fact, according to a survey by the Bank for International Settlements (BIS), a staggering 86% of central banks are actively researching the concept of central bank digital currencies (CBDCs) to ride the crypto wave while maintaining control over monetary systems. So it's very possible that we'll soon be able to use Digital Euros or Digital Pounds. However China is definitely the country leading the pack in this race, with transactions using China's digital yuan hitting 1.8 trillion yuan ($249.33 billion) at end-June 2023, marking a jump from over 100 billion yuan as of August 2022.

Now, you might wonder, why are central banks so intrigued by CBDCs? Well, here's the scoop: CBDCs are digital currencies issued by central banks, which provide a secure and regulated alternative to decentralized cryptocurrencies. These digital representations of fiat money aim to combine the benefits of traditional cash with the efficiency and traceability of blockchain technology.

But wait, what about Bitcoin and its crypto comrades? Central banks have been a bit skeptical about these decentralized currencies, mainly due to concerns over price volatility and potential risks like money laundering and financial instability. They often caution investors, comparing crypto investments to rollercoaster rides without safety belts (buckle up, folks!). However, it's worth noting that some central banks are not entirely dismissing the crypto craze. El Salvador, for instance, made headlines by becoming the first country to adopt Bitcoin as legal tender in 2021.

Climate change

Why discussing climate change in this article you might ask. Well it turns out central banks are now increasingly emphasizing the risks of climate change to financial stability. According to the Network for Greening the Financial System (NGFS), as of March 2023, there are 63 central banks around the globe that have integrated climate-related risks into their financial stability assessments. These central banks represent over 90% of global GDP.

Central banks are taking action on multiple fronts. For starters, they're incorporating climate considerations into their monetary policy frameworks. This means that factors like carbon emissions, sustainable investments, and green financing are taken into account when making decisions that affect interest rates and the overall economy. Take the European Central Bank (ECB) as an example. They're including climate change in their strategic reviews, evaluating how it impacts their policies and actions.

But that's not all! Central banks are also leading the charge in promoting sustainable finance. They're encouraging financial institutions to invest in green projects and align their portfolios with environmental objectives. The Bank of England, for instance, is requiring banks and insurance companies to stress test their operations against climate-related risks.

Now, let's talk numbers. In 2022 investments in sustainable funds have led to having nearly $2.8 trillion in Assets Under Management (AUM). This indicates a growing interest in environmentally friendly investments and a shift towards a more sustainable financial system.

International dynamics

Central banks collaborate through various channels, such as the Bank for International Settlements (BIS), to foster coordination and promote financial stability on a global scale. By sharing information, data, and best practices, central banks aim to prevent financial crises and mitigate conflicts that could send shockwaves throughout the markets.

To give you a couple tangible example, in 1985 the famous Plaza Accord was signed by five major economies— the United States, Japan, Germany, France, and the United Kingdom— to address imbalances in currency exchange rates. They wanted to tackle the overvaluation of the US dollar, which was causing economic imbalances and hampering global trade. Through negotiations, they agreed to a coordinated effort to devalue the dollar, leading to significant currency realignments and fostering more balanced economic growth.

On a more recent term, in 2021, the BIS launched the Central Bank Digital Currency (CBDC) Hub. The CBDC Hub is a forum for central banks to share information and collaborate on the development of CBDCs. And in 2022, the G20 announced a new framework for international cooperation on financial regulation. The framework is designed to strengthen the global financial system and to prevent future crises.

Conclusion

Phew! We've covered quite a bit of ground. But I hope it has been as illuminating for you as it was for me. Stay tuned for more deep dives into the financial world. Remember, knowledge is power - especially in the world of investing. So, keep learning and keep growing.