How Buy Now, Pay Later is winning over the credit cards market

With e-commerce volumes jumping forward an estimated 4-6 years due to worldwide lockdowns, consumers and merchants have increasingly looked to “Buy now, pay later” solutions to alleviate financial pressure and to meet online shopping demand, respectively.

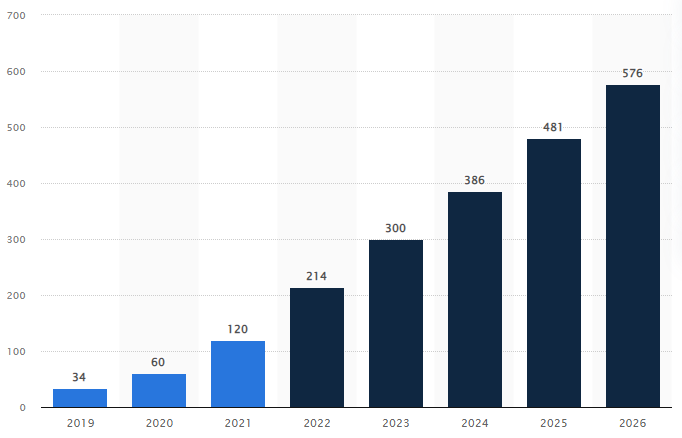

Today, BNPL reflects a small portion of the overall spending on payment cards (including credit, debit, and prepaid cards), however, there is growing evidence that BNPL is at an inflection point. By 2025, the global BNPL industry is expected to reach almost $500B in annual gross merchandise volume.

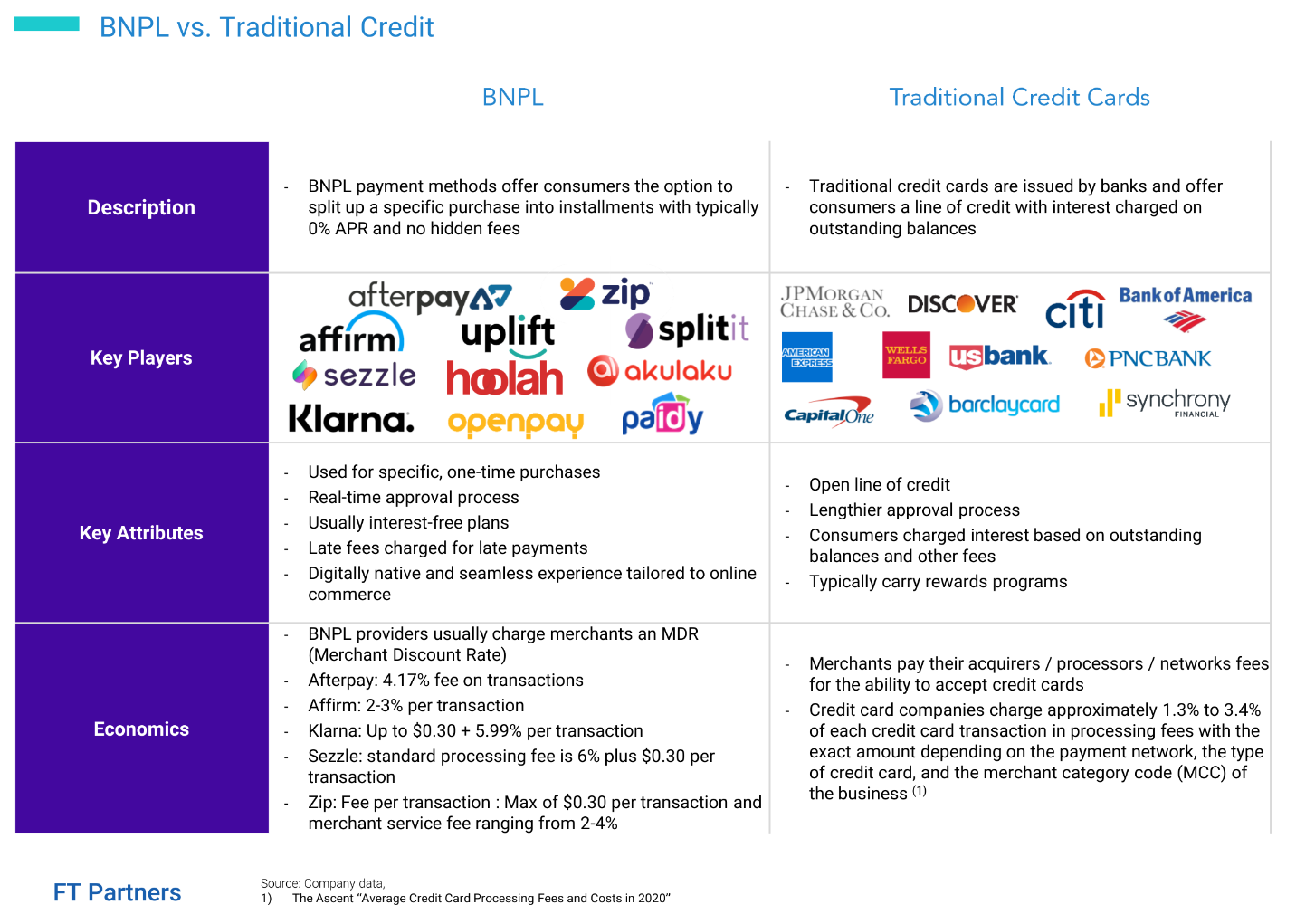

In the last few years, BNPL services like Afterpay and Klarna have become increasingly popular. This is due to their convenient payment options that allow customers to pay for items over several installments without having to incur high-interest costs.

These services also offer a great way for retailers to increase sales. By providing customers with more flexible payment options, retailers are able to attract more customers and make more sales.

What is buy now, pay later and how does it work

Buy now, pay later (BNPL) is a payment trend that allows customers to purchase items and defer the full payment for a period of time. BNPL agreements can be structured in various ways, but typically involve low-cost installments paid over several weeks or months.

It’s an attractive option for those who want to make a purchase but don’t have the funds ready and available. This type of payment option can also be used to help manage cash flow by spreading out payments over time instead of paying for an item in one lump sum.

With BNPL, customers can enjoy what they want today while having the flexibility to pay it off later.

Buy Now, Pay Later Product Configurations Vary by Country & Provider

While exact product configurations vary by provider and by country, due to regulatory reasons, offerings tend to fall into three main categories.

- Split Pay or Pay Later: to split a charge into multiple payments, with a portion paid at the time of the transaction and the balance paid in subsequent installments over a period of up to 4 months. This option usually carries no (or very little) direct cost to the consumer, though late fees may apply. Klarna popularized an option to pay within 14 or 30 days (rather than splitting), which makes sense for ecommerce purchases a user could end up returning.

- Longer term financing - purchase based: depending on the merchant and borrower’s qualification, longer term financing may also be available as an interest-bearing loan, something that Klarna, Affirm, and Zip offer, for example. In this case, the economics for the BNPL provider come from both the merchant and the consumer.

- Longer term financing - account based: rather than financing the specific purchase, the BNPL providers offer the chance to finance part of the outstanding balance. This can be decided after the purchase is done. Think of it as grouping together multiple loans.

When it comes to usability features, BNPL providers can offer a mix of the below:

- Rewards programs: these are proprietary rewards programs that combine cash-back offers from specific retailers (similar to rewards programs offered by legacy credit card issuers) with the ability for consumers to “unlock” additional rewards when certain usage thresholds are met such as changing payment dates or the ability to not have to make any up-front payment on eligible orders.

- Physical cards: this is to enable more in-store usage. Some BNPL cards are structured to turn each transaction into a pay-in-four loan, while others allow the consumer to designate a given transaction as pay-in-full or pay-in-four.

- Integration with ecommerce and payments platforms: to increase the scope of the BNPL apps. Klarna for example offers a browser extension that can automatically turn the offerings on a retailer’s website into BNPL loans with a single mouse click. Another popular feature is shopping that occurs directly in social media feeds or on content publishers’ platforms (social commerce).

- Integrated shopping apps or "super apps": the BNPL players create super apps (a centralized, one-stop app that enables consumers to shop at different virtual marketplaces without the hassle of signing in and out of various apps) with well-integrated shopping, payments, financing, and banking ecosystems on a single platform. The super app persuades low and high credit history customers to spend conveniently using BNPL.

Market size

In December 2021, the Consumer Financial Protection Bureau (CFPB) issued market monitoring orders to five lenders to provide data on their BNPL loans. From 2019 to 2021, the number of BNPL loans originated in the U.S. by the five lenders surveyed grew by 970 percent, from 16.8 to 180 million, while the dollar volume of those originations (commonly referred to as Gross Merchandise Volume, or GMV) grew by 1,092 percent, from $2 billion to $24.2 billion. The average individual order value (i.e., average purchase amount financed by a BNPL loan) in 2021 was $135, up from $121 in 2020.

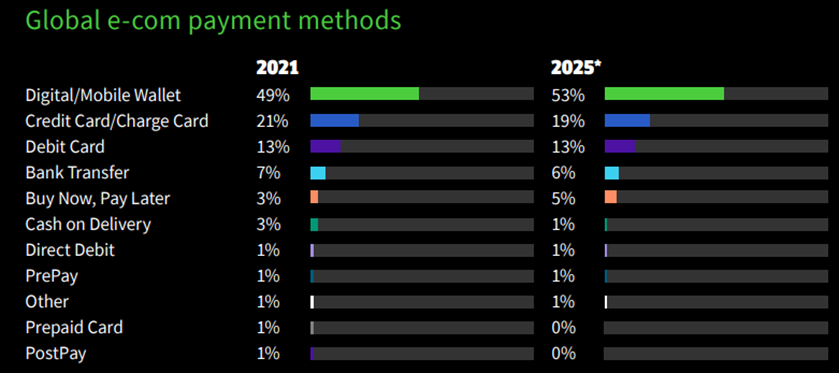

Overall 2021 witnessed strong global e-commerce growth of 14% YoY as the global economy – and the travel sector in particular – began to recover from early impacts of COVID-19, exceeding US$5.3 trillion in transaction value. BNPL accounted for 3% of such value worldwide in 2021, with a peak of 24% for Sweden. Market penetration is expected to keep growing, reaching a value of 5% by 2025.

Millennials and Gen Zers represent a disproportionate percentage of users bolstering BNPL companies, with the average customer leading BNPL providers being in their early 30s. While over 70% of millennials and roughly half of Gen Z across have credit cards, BNPL is increasingly coming into focus as an attractive alternative to paying with credit. In a survey of over 1,800 people, two of the most commonly cited reasons for using BNPL were the ability to avoid paying credit card interest and to make purchases that wouldn’t fit in a budget.

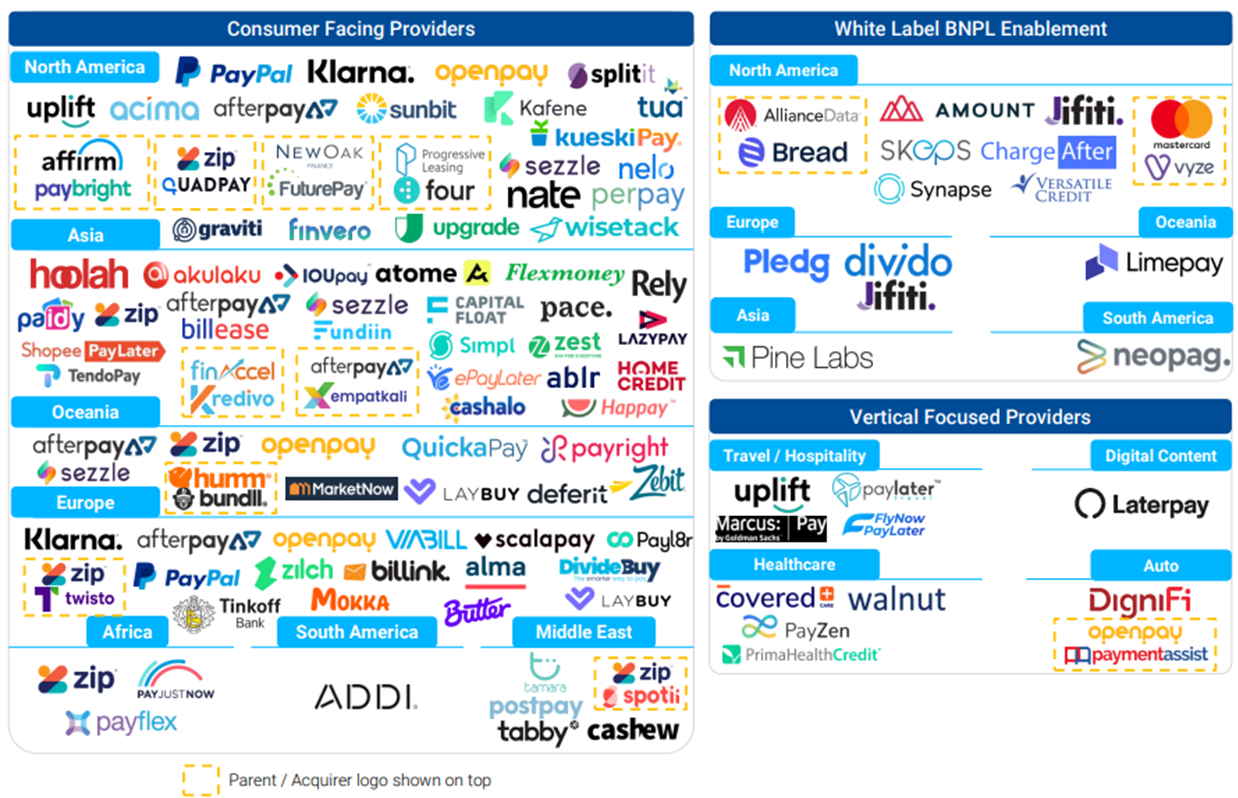

The competitive landscape is constantly moving and new players are entering the arena either by expanding their offering or by buying existing players. A non-exhaustive view is the folllowing:

Fintechs Vs. Banks

Though banks and traditional lenders offer online credit installments to consumers, Fintechs have established themselves as trailblazers in capturing ultimate value from BNPL. According to McKinsey’s Consumer Lending Pools data, fintech firms have redirected $8 to $10 billion annual revenue to themselves from banks.

Banks are bound by stringent regulatory compliance requirements. And they are relatively less open to disruption and innovation. This makes it very challenging for them to innovate and extract maximum value from microcredits.

Most banks and traditional lenders limit BNPL only to financing checkouts. They do not go the extra mile to stitch BNPL with the holistic purchase journey of the customer. Nor do they leverage their scale to direct consumer traffic to merchants. Heavy regulations, higher credit reporting, and strict compliance requirements limit bank’s power to deliver out-of-the-box BNPL services and seamless checkout experiences.

However, neo banks are looking beyond hurdles to innovate instant credit ecosystems and build significant scale by partnering with fintech service providers.

Credit assignment strategy

BNPL lenders’ underwriting models work in concert with their strategies on how much credit to extend to each approved applicant. Many lenders employ a “low-and-grow” strategy: extending limited credit to first-time borrowers, and gradually raising the amount of credit extended as the borrower exhibits positive repayment behavior. While a general low-and-grow strategy is commonplace in the BNPL industry, the exact amount assigned to first-time borrowers is not.

The app-driven acquisition model has made the amount of available credit for which a consumer is qualified much more explicit. Upon logging into the app, users are often guided to immediately apply for credit (before they have selected a purchase). Approved users are then typically presented with a purported available credit amount, sometimes referred to as “purchase power”. The approved amount is usually considered a placeholder until the user actually attempts to take a BNPL loan, at which point they are re-underwrite.

Drivers of success

Companies leading on BNPL have unlocked a winning combination of technology and product innovation that speaks to the needs of a connected, trend-driven, and digitally adept generation. However, alongside solid core propositions, the best players have developed capabilities to enable excellent performance along six key dimensions:

- An exceptional UX: a simple customer interface, offering an easy-to-use process, supported by best-in-class functionality such as single sign-on, one-click checkout, and the option to buy on social media platforms.

- Cutting edge risk management: that will enable faster, more accurate decision making, based on advanced analytics and the ability to speedily process large volumes of data. Besides KYC capabilities for merchant onboarding and strong credit assessment, BNPL firms require debt collection policies, including for dunning fees and collection agencies.

- Strong consumer brand: the biggest BNPL companies have developed strong consumer brands. This has helped them enrich their value propositions to merchants, driving incremental sales through affiliate marketing channels. In addition, it has allowed them to expand their consumer relationships to offer additional products.

- Easy integration: they leverage multiple distribution channels, including direct integration with merchants, as well as with technology providers for web shops (such as Shopify or Magento).

- Bold internationalization: Some firms have been decisive in expanding across borders, often acquiring competitors to establish market position.

BNPL benefits for merchants

BNPL brings a couple important benefits to the merchants:

- Higher conversion rates and average order value (AOV): splitting and delaying the payment, often with no interest, does help in converting customers

- Remove the credit risk: by shifting that to the BNPL companies, which are now on the hook for collecting the money.

- Greater customer retention: the BNPL ecosystem, often wrapped within user friendly apps, does help to keep customers coming back.

All the above is not free though, as the price (for the merchant) is fees can often be 2-3x what Visa and Mastercard typically charge, called “merchant discount rate” (MDR).

Advantages of BNPL for shoppers

Shoppers also benefit from using BNPL that we could group into two main advantages: financial benefits and Operational/UX benefits.

Financial benefits

- No high-interest costs or incur late fees. Borrowers who miss BNPL payments may be prohibited from future use until they repay or face late fees, but those fees are relatively low in absolute terms and do not compound as does credit card interest.

- Additionally, customers can enjoy greater flexibility when it comes to payments since they can choose to spread out their payments over several weeks or months.

- The BNPL industry also posits that the product, unlike a typical general-purpose credit card, is not debt-cycle-inducing. Because BNPL lenders underwrite each purchase individually and do not charge interest, they argue that they have incentive-aligned, debt-cycle-preventing guardrails.

Operational and UX benefits

Compared to legacy credit predecessors, BNPL offers an easy-to-use, convenient experience. Features that set them apart include:

- An instantaneous credit decision

- A straightforward repayment structure

- An integrated and seamless shopping experience, especially when using the superapp, that allows users to instantly browse from dozens of products and brands (which often becomes tailored to the interests and tastes of the individual user)

While the amount of information a user must supply varies by product, all BNPL providers provide a streamlined, low-friction experience — often requiring no additional fields beyond a merchant’s standard checkout flow.

Criticism on BNPL

Critics of BNPL have argued that the practice could be predatory to the less financially sophisticated, especially those living paycheck-to-paycheck and can’t afford to split payments. Most criticism focuses on:

- Overextension Risks: many BNPL consumers may not be simply shifting their existing purchases to a new payment platform; they may be spending (and borrowing) more than they otherwise would.

- Loan Stacking: a borrower could take out concurrent BNPL loans at different lenders and not be unable to repay some or all of them. The typical BNPL purchase only requires a 25 percent down payment with no interest, and the product is often available from several lenders at virtually every digital retailer. Additionally, because most BNPL lenders only make “soft” credit bureau inquiries, BNPL lenders have no visibility into an applicant’s borrowing activity on other BNPL platforms. BNPL lenders often point to their low-and-grow strategies of assigning low credit amounts to first-time borrowers that slowly increase over time with on-time payments as evidence of appropriate usage guardrails. However, these guardrails can erode if borrowers have access to concurrent BNPL loans from several lenders.

Conclusion

Buy now, pay later (BNPL) services offer a range of advantages for shoppers and merchants alike. From instant credit decisions to flexible payment options, BNPL products can be an attractive option compared to traditional financing or general-purpose credit cards. However, it is important to understand the potential risks associated with these services in order to ensure responsible use and prevent overextension or loan stacking issues. Ultimately, understanding how BNPL works and its implications on your finances will help you make informed decisions when considering this type of product as part of your shopping experience.