Accounting 101: financial statements introduction

Although there are a lot of numbers in accounting and finance, it is not an exact science. This is because:

- In many cases they are estimates of reality.

- Different countries have different rules and follow different standards

- International standards often are not very strict in terms of the structure for the financial statements, instead they focus on the minimum content that has to be included

- There is space for interpretation of the terms

- You can play with the value of certain items e.g. depreciation years/value, allocation of costs, valuation of an asset etc.

Does this all mean that there is no structure or commonalities in the different financial statements? Not at all! Just keep reading...

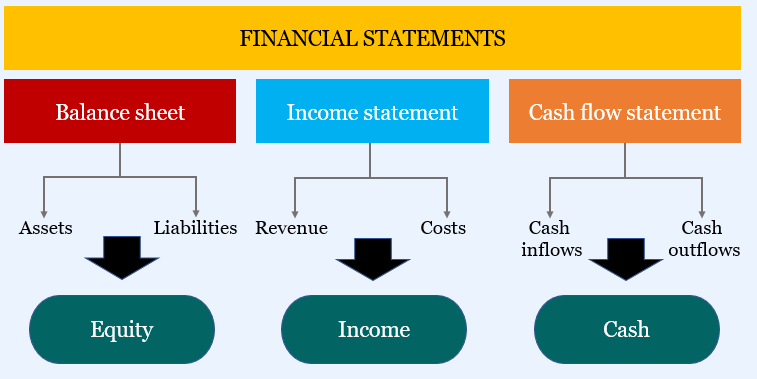

Financial statements in a nutshell

There are documents that show the capacity of a company to generate or destroy value: the financial statements. On a high level they can be grouped into three blocks:

- Core documents, basically composed of numbers only. These are: balance sheet, income statement, cash flow statement.

- Attachments to the core documents, they are wordy documents and help understand the core documents. These are: statement of changes in shareholders equity, notes to the financial statement.

- Extra documents, that complement the core and help draw a better picture of the company. Some examples are: Directors' report, press releases, auditor's report, report of the board of statutory auditors.

Let's spend a few more words on the core documents as we will analyze them deeper in other articles.

- Balance sheet: composed of Assets (investments) and Liabilities (debts=sources to finance the investments) that the company has done. It helps to understand if the company will be able to survive long term.

- Income Statement: also known as Profit and Loss statement, is composed of Revenues and Costs. It tells if the company generates a profit from its investments. It’s a snapshot of the last year performance (short term).

- Cash flow statement: compares cash (and cash equivalents) entering and leaving the company and shows the capacity (during the fiscal year) to produce cash. As we'll see, income and cash are not the same thing.

Who needs the financial statements?

Financial statements might be perceived as a boring thing, only needed by top Executives of the company and Government institutions to calculate taxes. This could not be further from the truth. In fact, they provide information to all parties that get in touch in a way or the other with the company:

- Shareholders: they can understand the profitability of their investment and the capacity of the company to pay dividends regularly

- Creditors: they can evaluate the capacity of the company to pay interests and reimburse the debt on time

- Suppliers: they can evaluate the capacity to pay debts regularly

- Employees: they can evaluate the profitability of the company, hence the stability of their employers

- Customers: they can evaluate the continuity of the company, especially when they plan to built a long term relationship with them

- Governments and other institutions: they can evaluate the profitability of the companies, in order to define potential fiscal policies and to have some data to calculate the national revenue.

The financial statements are therefore used to protect third parties and help them understand how the company is doing in a given period of time.

How are financial statements created?

Financial laws and accounting standards (created by professional institutions) dictate how the statements should be created. This is needed to make them understandable and comparable across international boundaries (and help prevent malicious behavior).

Most countries nowadays follow the International Financial Reporting Standards, commonly called IFRS, with the exception of the United States where US Generally Accepted Accounting Principles (GAAP) is applied.

Each country generally has specific principles that allow for special cases (eg small companies) where a simplified/shorter version of the statements is allowed.

There are differences in the two standards that I will not cover here, but one thing worth to note is that IFRS is Principles-Based while GAAP is Rules-Based. In practice, this means that IFRS doesn’t dictate a super strict structure but principles to follow (e.g. minimum information that has to be provided) when preparing the statements. The advantage is that such guidelines can be adapted to virtually any company, without compelling managers to manipulate the statements to fit what is compulsory. On the other hand, having strict rules that need to be followed, like those in the US GAAP system, can increase accuracy and reduce the ambiguity.

It should be now clear that if you learn how to read the financial statements, you'll get a good understanding on the health of the company - an essential information when you decide to invest your money into it.

Now that you got an overview of the statements, it's time to dig deeper into each one of them with dedicated articles: